As recently as March 2024, a Daily Mail headline bemoaned “The Rise of Loyalty Card Rage” as the key concern for the modern grocery shopper. It seems fitting after all that in a digital age where data and AI pervade every aspect of our daily lives, our traditional grocery shopping irks have been digitised. Traditional irritations about the wonky trolley wheel, the barcode that won’t scan, or the lack of available baskets have been replaced by frustrations about the need to sacrifice your name, date of birth, address, mother’s maiden name, sexual preference and the breed of your first pet in the pursuit of a cheaper tin of beans at the till.

The value of this data to the supermarkets is immense, but do loyalty cards really offer the consumer better value? And how have loyalty prices changed the pricing landscape in the UK Grocery sector?

Since the introduction of Tesco Clubcard back in 1995, the notion of loyalty and member schemes has always been part of the UK retail psyche. Within a year of its launch, the merits of Clubcard for Tesco were beyond question: Clubcard shoppers were spending 28% more in-store than non-Clubcard Shoppers. Potentially even more importantly, Clubcard locked in spend of Tesco shoppers and reduced their promiscuity: Clubcard shoppers not only spent more in Tesco but they also spent 16% less in UK rival Sainsbury’s than they had previously. Within a year, Safeway had followed suit with the launch of their ABC Card and in 1997 the loyalty bug spread outside of the supermarket world with Boots’ Advantage card sliding into customer’s wallets.

And so it was for 24 years, loyalty cards largely existed to generate a rainforest sized industry of glossy voucher and coupon leaflets to incentivise customers to buy extra items when they shopped. 2019 however saw the retail world turned upside down with the introduction of Tesco Clubcard Prices for the first time as part of the retailer’s ‘100 Years of Great Value’ campaign. Within 4 years, Clubcard Prices now operate on over 8000 Skus and represent 80%+ of the retail giant’s sales. Sainsbury’s has followed suit with 2023’s introduction of Nectar Prices, with 70% of the retailer’s sales coming through loyalty purchases. The shift towards loyalty pricing has precipitated a rush to avoid being left behind with the launches of Co-op Member Pricing, Lidl Rewards & Morrisons More Card. Only ASDA has deviated from the member pricing angle by instead incentivising shoppers with cash back into a ‘Cashpot’ when making their regular purchases or completing various shopper ‘Missions’ in an attempt to gamify the loyalty platform. Asda shopper’s Cashpot can then be redeemed against the value of the shop overall rather than only discounting specific products.

The answer to such a question is relatively complex. The advent of seismic inflation in the global economy at large brought about by the war in Ukraine and Mary Elizabeth Truss’ brief yet ‘eventful’ premiership largely coincides with the switch from regular offers to member pricing and so makes a clean comparison hard to gauge. One aspect of the value equation is beyond debate however, loyalty pricing offers shoppers significantly greater value than non-membership. So great is the disparity between the prices you are offered using your Nectar or Clubcard and those if you leave it at home, that one Daily Mail reader declared ‘I think if I ever forgot my Clubcard at Tesco I'd have to file for bankruptcy’.

While it might seem overdramatic, the facts lend credence to the idea that in the modern era, shoppers cannot afford to be without a loyalty membership. Figures from an investigation by The Grocer found that shoppers holding a Tesco Clubcard have saved on average £4.15 a week since the start of 2023. Such a saving represents a 5.4% discount on the average cost of a shopping basket in that period which stood at £75.98. A Nectar card would save you even more, The Grocer discovered, with Sainsbury’s loyalty scheme saving its customers 6.5% or £4.79 a week on the average £72.24 basket.

When it comes to the question ‘do loyalty prices offer better value than what came before or what shoppers can access elsewhere?’, the answer is less clear. A cursory look at some of the staple grocery promotions across the market will point to the fact that 19 Crimes Red Wine, last promoted to £8 as a Clubcard Price and Nectar Price was also available on promotion to shoppers in ASDA and Morrisons at the same price without the need for membership and the sacrificing of their data. Budweiser 20x300ml shows a similar pattern with Clubcard and Nectar offers at £12 matched by their non loyalty counterparts in ASDA. The picture gets even worse for loyalty pricing when we consider Kellogg’s Crunchy Nut 500g cereal, where not only is last Tesco Clubcard promotion of £3 beaten by ASDA’s most recent £2.75 promotion but it is gazumped by Morrison’s much more attractive £2 promotion running without a loyalty paywall. There are examples of where loyalty prices do offer more compelling value but these instances are largely to be found on niche, less crucial lines for customers as an added incentive to purchase. The contention of this article is that, more often than not, loyalty prices merely give shoppers access to the same promotions that the retailer offered without the need for loyalty membership previously, or prices they can access without the need for loyalty membership elsewhere. Indeed, there are numerous examples of where loyalty prices offered to customers are not even the most attractive in the market and so the conclusion cannot be that member pricing guarantees better value for the shopper.

There is no getting away from the seismic risk Tesco took following 2019 in deciding to move its entire promotional offering to Clubcard Pricing. Rarely has a UK retailer demonstrated such bravery in pursuing its strategy so relentlessly and with such conviction, accepting of the short term tumult it might cause. It is to Tesco’s eternal credit that such a step was not done in baby steps or by ‘dipping a toe in the water’ - they dived in head first and shoppers followed by taking the plunge with them. The first benefit has been to ‘lock in’ shoppers through the perception created that Clubcard membership saves their shoppers so much each and every visit. Customers can often be observed studying the receipt to see how much their Clubcard saved them on their visit and proudly sharing this information with friends or family. The fact they were saving the same amount of money before the advent of Clubcard prices, when it was just called a promotion, is largely unappreciated by the modern consumer.

Secondly, as with every walk of life, data is fast becoming the most valuable commodity going, and in retail it is no different. The data gleaned through loyalty memberships is hugely beneficial to retailers, not only in understanding who their customers are, but more importantly how they shop. The forensic nature of the data retailers gather through their loyalty scheme allows them to understand changes in shopping behaviour, switches from one brand to another, moves to buying bigger or smaller pack sizes, movements between brand and private label products and shifts in seasonal purchasing patterns, among other things. Such information is vital in informing retailer decision making on ranging, pricing, promotions, store locations, replenishment strategies, store layouts and wider product development trends. It can be argued therefore that the shopper ultimately benefits in kind from the sacrificing of their data as they are more likely to find their shopping experience more attuned to their wants and needs.

Finally, and more controversially, loyalty pricing also affords retailers greater flexibility when it comes to how often products can be promoted and to what prices. Traditional, non loyalty promotions have always been governed by the CMA and ASA notions of Price Establishment which ensure that any reference prices are genuine and do not mislead the customer. This notion arose out of a need to avoid the situation once common in the furniture industry where a sofa reduced from £1000 to £499 had never actually sold for £1000 save for one week in January in one store in the Outer Hebrides. With loyalty pricing however, the reference price is suddenly a much darker art - essentially it is the non-loyalty price and so, in theory, was no longer dependent on price establishment rules. An investigation by Which? in September 2023 began highlighting the potentially misleading nature of some of the loyalty promotions on offer from retailers. The contention being that, if 80% plus of your sales go through loyalty pricing, can the non-loyalty price really be considered a genuine reference price? Such focus has triggered a CMA investigation into the validity of loyalty pricing and as such, the debate is sure to continue under the board’s microscope.

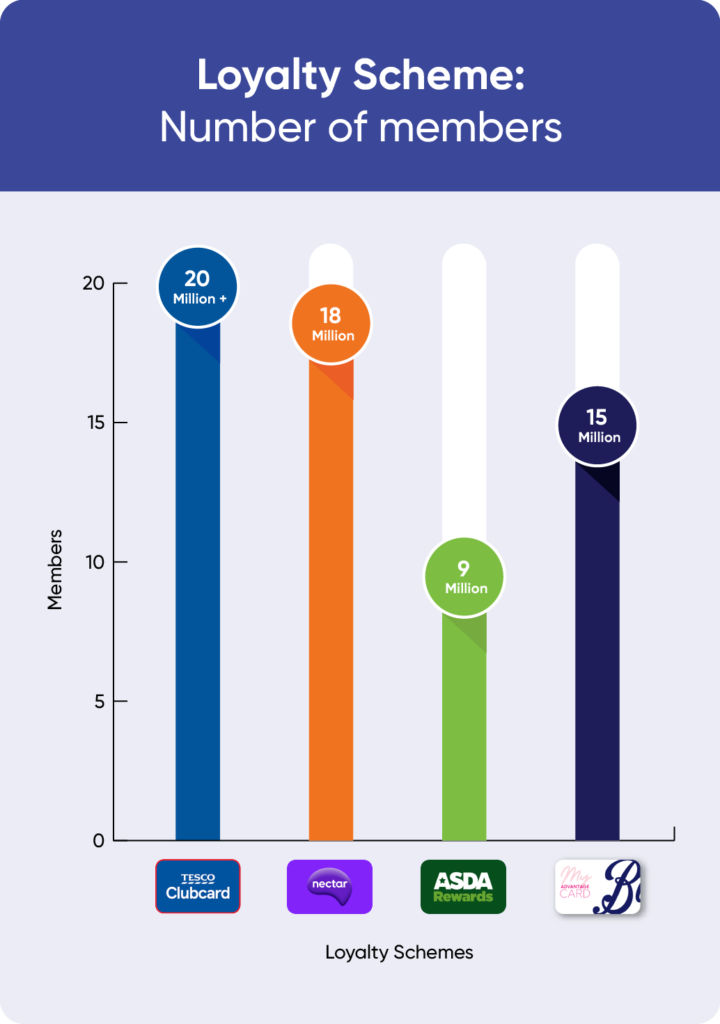

What is beyond question however is that the advent of loyalty pricing within the UK Grocery Market has been the biggest shift in retail strategy and shopper behaviour of the decade thus far. All four of the traditional multiple grocers are charging forward with their respective schemes and with over 47 million memberships across Clubcard, Nectar Card and ASDA Rewards alone, it is clear shoppers are sold on the benefits. The perennial fly in the ointment for the traditional ‘Big 4’ remains - while they continue to place their best value for shoppers behind their data ‘paywall’, Aldi continue to seize share and shoppers, offering their synonymously low prices to anyone who walks through the door. In doing so, do Aldi create more loyalty than any card ever could?

RESOURCES:

https://www.theguardian.com/lifeandstyle/2003/jul/19/shopping.features

https://www.thegrocer.co.uk/fmcg-prices-and-promotions/how-are-loyalty-schemes-shaking-up-the-price-wars-in-grocery/684217.article