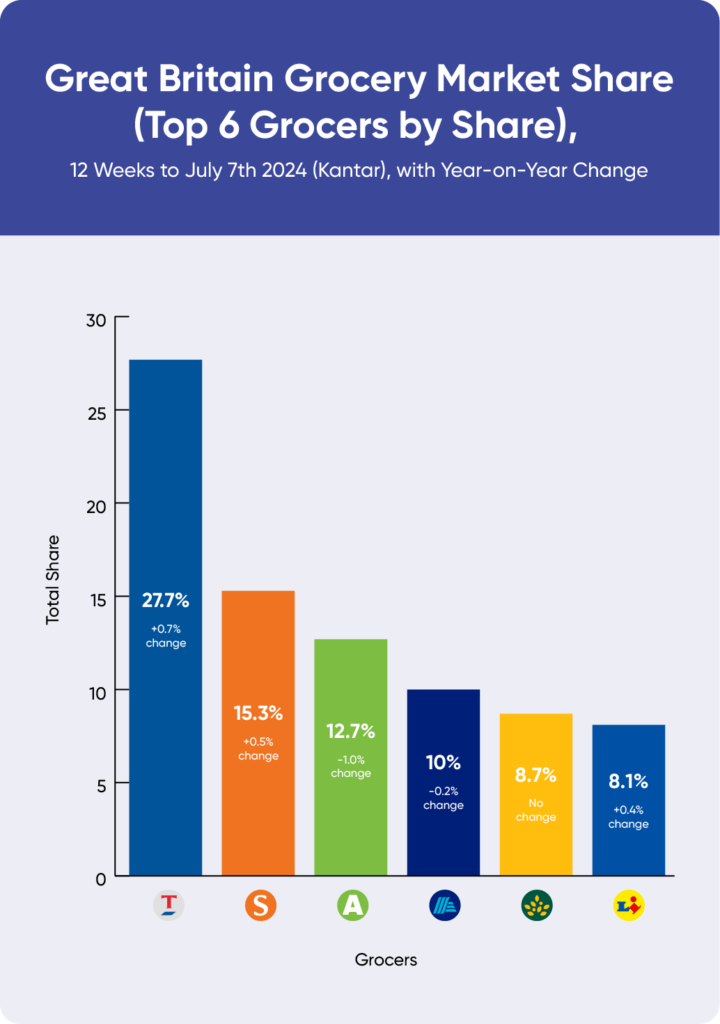

However, there are positive signs for online market share, with key sectors such as online Grocery and Beauty, Personal Care (BPC) showing significant growth. In April, the total online Grocery category reached a share of 12.0% for the first time since July 2022. ASDA announced in their Q1 results that Online grocery represented 18% of food sales, driven by a 5.6% increase in the number of average weekly orders; their overall grocery share has seen a decline of 1% in the 12 weeks to July 7th though, and it will be interesting to understand this from their Q2 results.

As recently as mid-July, Kantar announced Ocado as the fastest-growing grocer for the fifth month in a row, improving sales by 10.7% in the 12 weeks to July 7th. Similarly, Boots saw strong growth across digital channels, with boots.com sales up 16.8% in their Q2 financial year result. Despite these positive trends, the Consumer Packaged Goods (CPG) category growth ambitions by the end of 2024 are far from guaranteed and online sales will need to play a key role in the overall success. Creating organic demand and identifying incremental sources of growth, outside of promotions, is critical. Let's delve into the top challenges and some tips on how to approach them.

The primary challenge remains managing promotions and pricing amidst changing economic conditions. Inflation is cooling across Europe, prompting brands and retailers to extend promotions to more CPG categories to maintain sales. However, is this significant increase in promotional activity sustainable? Private label penetration and oversaturated promotional strategies could result in a zero-sum effect, reducing profitability without truly creating organic demand. Here are some strategies to look out for when it comes to your e-commerce pricing and promotions.

Ensuring visibility in a crowded online marketplace is difficult but critical for driving organic demand. This involves keeping up with media standards and getting creative with content to capture consumer attention.

Securing a share of search and digital shelf is increasingly difficult due to the rise of sponsored search capabilities and overwhelming advancements in AI. It’s never been more important to adopt a digital shelf analytics tool to track your performance and the movements of your competition.

E-commerce managers must stay vigilant to consumer behaviour and market trends to address issues proactively. Consumers are becoming more knowledgeable about product ingredients and sustainability credentials, which poses a major challenge for e-commerce managers.

Balancing customer expectations for fast, reliable delivery while managing costs and avoiding out of stocks is a significant challenge. E-commerce managers need to ensure that their supply chain is robust and responsive to market demands.

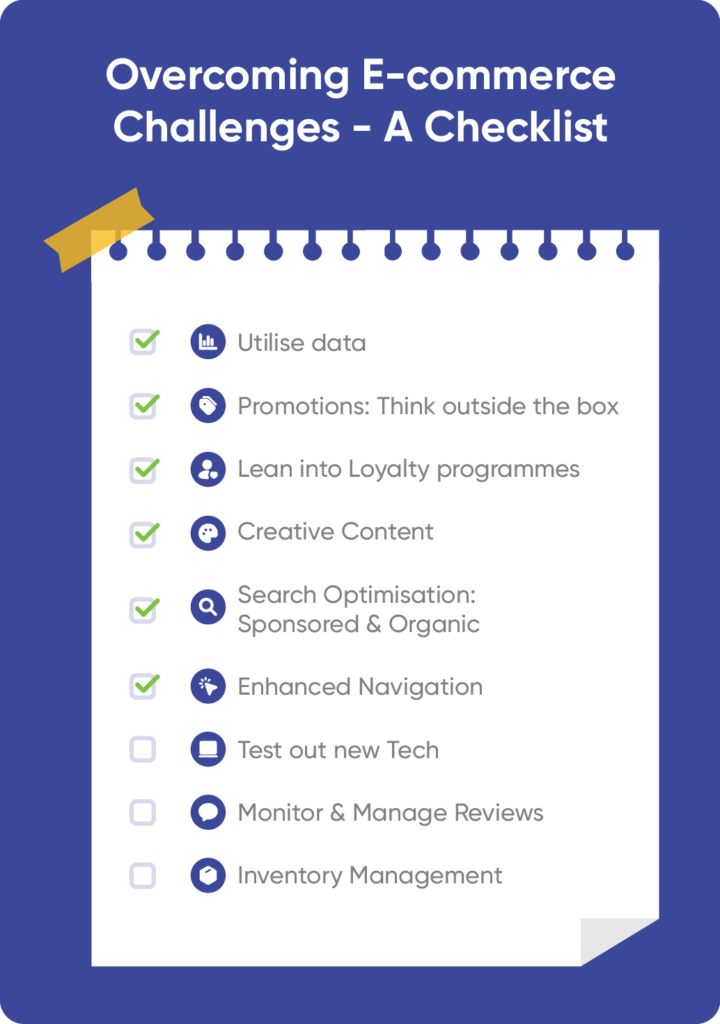

Addressing these challenges in 2024 requires e-commerce account managers to be proactive, strategic, and adaptive. By focusing on innovative promotions, standing out with creative content, optimising for search, engaging with savvy consumers, and ensuring product availability, businesses can navigate the complexities of the evolving e-commerce landscape and drive growth. Leveraging e-commerce monitoring and intelligence tools will be essential for e-commerce managers to succeed in the competitive market.

RESOURCES:

Households save £1.3 billion on supermarket deals (kantar.com)

https://corporate.asda.com/newsroom/2024/17/05/asda-updates-on-q1-2024-trading-delivering-continued-growth-driven-by-investment-in-value-and-george

https://www.kantar.com/uki/inspiration/fmcg/2024-wp-falling-inflation-football-and-fake-tan

Boots UK - Boots positive momentum continues with excellent Christmas and digital growth driving strong Q2 results (boots-uk.com)

https://www.linkedin.com/posts/-tesco_more-families-than-ever-are-struggling-to-activity-7191821276343066624-EzPH?utm_source=share&utm_medium=member_desktop