GroupM, which as of 2023 is the world’s largest media buying agency, believe that retail media advertising spend will surpass that of TV advertising revenue spend by 2028, reaching over 15% of total advertising revenue.

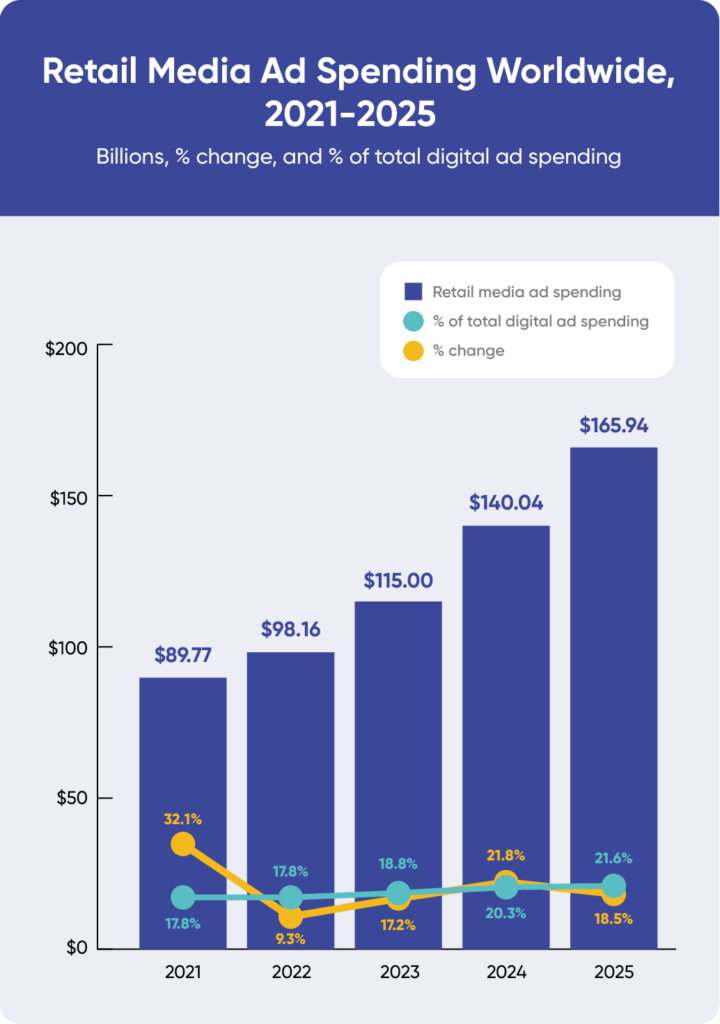

eMarketer believe that worldwide retail media spend will hit $140 billion in 2024, an increase of almost 22% on 2023 spend. Growth in spend has been in double digits for at least the past few years, with the exception of 2022 when the year-on-year growth dipped to 9.3% in the aftermath of the COVID-driven 2021 digital boom.

For years manufacturers have been spending money on various forms of media, including TV advertising, in store activation and online banners, with limited data provided in return to allow them to understand if it was worth it. Of course, if brand building and awareness is the primary media objective, then metrics such as reach and impressions are helpful enough to justify continued spend, and TV advertising can be a strong media format. If, on the other hand, the primary aim is lower down the marketing funnel - on conversion or even loyalty - the ability to accurately measure return on ad spend (ROAS) has long been a challenge.

Retailers are starting to see the opportunities presented by selling more retail media on their websites, and they are adapting their approaches to encourage greater spend. As well as the additional digital advertising revenue, more effective media will also result in more products sold, a win:win that earns the retailer money in multiple ways. This is one of the reasons retailers are advancing their retail media capabilities, and starting to work with companies like CitrusAd to modernise and provide self-serve media opportunities such as sponsored products, banner advertising and branded landing pages. They are having to invest in capabilities, but given that the Boston Consulting Group have observed on-site retail media margins of between 80 and 90%, it seems more than worth it.

Let’s look at Sainsbury’s Nectar360, which claims that campaigns can be made smarter by using customer data to ‘reach the right people at the right time.’ Instead of the previous approach, which was to plan and book banners for fixed time periods months in advance, campaigns can now go live within minutes. In addition, Nectar360 claims to provide a ‘precise measure of campaign performance,’ which is likely a hugely welcome bonus for FMCG manufacturers. Time spent trying to justify increasing or even flat retailer media spend in the past can now be cut much shorter with actual performance data to help. This works both ways though, of course, as if budgets simply aren’t available then positive ROAS data may be used by retailers to a manufacturer’s detriment. The availability and power of data will be one of the reasons why Sainsbury’s forecasts that Nectar360 will contribute an incremental £100mn of profit contribution over the 3 years to 2026.

Targeted campaigns can help improve the online shopping experience for consumers, who are surely more likely to buy products similar to those they have bought before. As a vegan writing this, I can confirm that there is nothing worse when doing my weekly online shop than having meat and dairy products digitally shoved down my throat. It remains to be seen how retailers will adapt moving forward; there’s a fine balance between successful personalised retail media campaigns driving high-margin ad spend, and the possibility of taking it too far and over saturating websites with too many ads.

Being able to manage campaigns in real-time and understand campaign performance is a huge win for manufacturers, but it still has its limitations. Firstly, it is much more time consuming to manage campaigns rather than plan them in advance and then let them do their thing. Secondly, retail media performance data is still sporadically available, with a lack of consistent measures available across all retailers in order for manufacturers to draw strong conclusions on how and where to spend their hard-fought-for cash. This is something that Brand Nudge can help with; our Data Science team have helped some of our Digital Shelf clients with a consistent ROI measure across retailers, stripping out other key sales drivers such as price or promotions at the same time. This allows us to advise on the best way to spend your money, at both a retailer and campaign level. Get in touch with your Customer Success Manager if this is of interest, and let’s chat about how we can support you in optimising your retail media spend.

RESOURCES:

https://www.reuters.com/business/retail-consumer/retail-media-ad-revenue-forecast-surpass-tv-by-2028-2023-06-12/#:~:text=GroupM%2C%20the%20world's%20biggest%20media,15.4%25%20of%20total%20ad%20revenue.

https://www.emarketer.com/content/retail-media-accounts-one-fifth-of-worldwide-digital-ad-spend

https://citrusad.com/retail-media-for-advertisers

https://www.bcg.com/publications/2023/first-party-data-leads-next-growth-engine-in-retail#

https://www.nectar360.co.uk/what-we-do/data-and-insights/targeted-media-communications-analytics/

https://advertising.amazon.co.uk/help/GX7KDKHMWQYMJ385

https://www.ft.com/content/26959b97-90ad-4bc1-b9df-1b7461ba71f9